🚨 FREE ASSESSMENT TOOL

The CPA Evaluation Toolkit™

Are You Getting Strategic Value or Just Compliance Services?

The 5-minute assessment that could save you $50,000+ annually. Most business owners think their "good CPA" means they're financially optimized. The truth? 90% of CPAs provide excellent compliance but ZERO strategic planning.

🚨 The Reality Check

This 5-minute assessment reveals exactly what you're missing and what it's costing you.

90%

of CPAs provide only compliance services

$50K+

Average annual overpayment

$2M+

20-year compound cost

The 15-Question Strategic Value Assessment

Our comprehensive evaluation covers three critical areas where most CPAs fall short:

Tax Strategy & Multi-Year Planning

Wealth Building & Advanced Retirement

Strategic Advisory & Growth Planning

Industry Expertise & Professional Network

Proactive Opportunity Identification

Sample Assessment Question

Does your CPA schedule annual tax planning meetings (separate from tax prep)?

□ Yes, 2+ strategic planning meetings per year (5 pts)

□ Yes, 1 annual planning meeting (3 pts)

□ Only discusses planning during tax prep (1 pt)

□ No, we only meet for tax filing (0 pts)

+ 14 more strategic questions

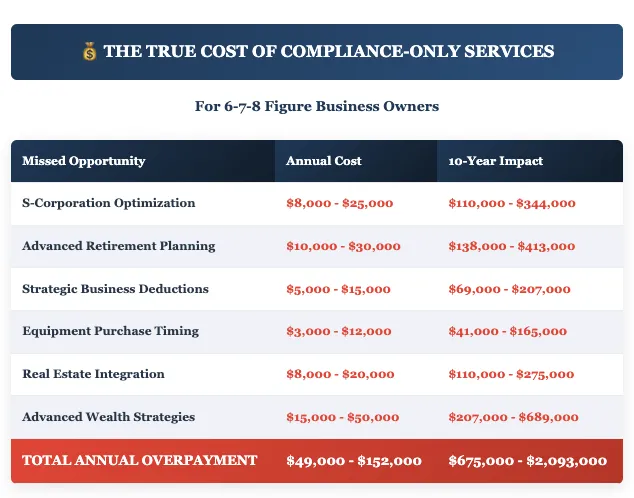

💰 The True Cost of Compliance-Only Services

For 6-7-8 Figure Business Owners

⏰ The Compound Cost of Waiting

$675K - $2.1M

10-Year Cost

$2M - $6.2M

20-Year Cost

Here's what some of our clients have to say...

"We went from paying $85,000 in taxes to saving $42,000 annually with just the S-Corp election and advanced retirement planning. My pharmacy operations didn't change at all - I just keep twice as much of what I earn now."

- John D.

Pharmacy Owner, North Carolina

"My CPA never mentioned these strategies in 12 years. We're now saving $67,000 annually in taxes and building a real estate portfolio with the extra cash flow. I wish I'd found this 10 years ago."

- Michael R.

Construction Company Owner, Texas

"I was stuck paying $38,000 in taxes every year with nothing saved for retirement. Now I pay almost zero in taxes and contribute $158,000 annually to tax-advantaged accounts. It's like getting a $196,000 raise."

- David S.

Commercial Cleaning Business Owner

Ready to Stop Overpaying and Start Building Wealth?

Don't let another tax season pass without addressing these gaps. The compound cost of inaction is simply too high.

"At Preserve Wealth Group, we believe that people who create real value should be able to keep and grow their wealth — not be punished for success."

- Joey Lalonde, Founder

30 North Gould Street, Sheridan,

WyomingUnited States

Privacy Policy | Terms & Conditions | Contact Us

© 2025 Preserve Wealth Group LLC

All Rights Reserved.